Trusted Partners

Secure it. Design it. Fix it. Host it. Automate it. SKUNKWORK™ it.

Get your dedicated creative & website management team with UNLIMITED professional support, including website maintenance, proactive security monitoring, web development, graphic & print design, fixes & updates, E-commerce management, premium hosting (WordPress) & AI integrations — ON DEMAND 24/7.

Get your dedicated creative & website management team with UNLIMITED professional support, including website maintenance, proactive security monitoring, web development, graphic & print design, fixes & updates, E-commerce management, premium hosting (WordPress) & AI integrations — ON DEMAND 24/7.

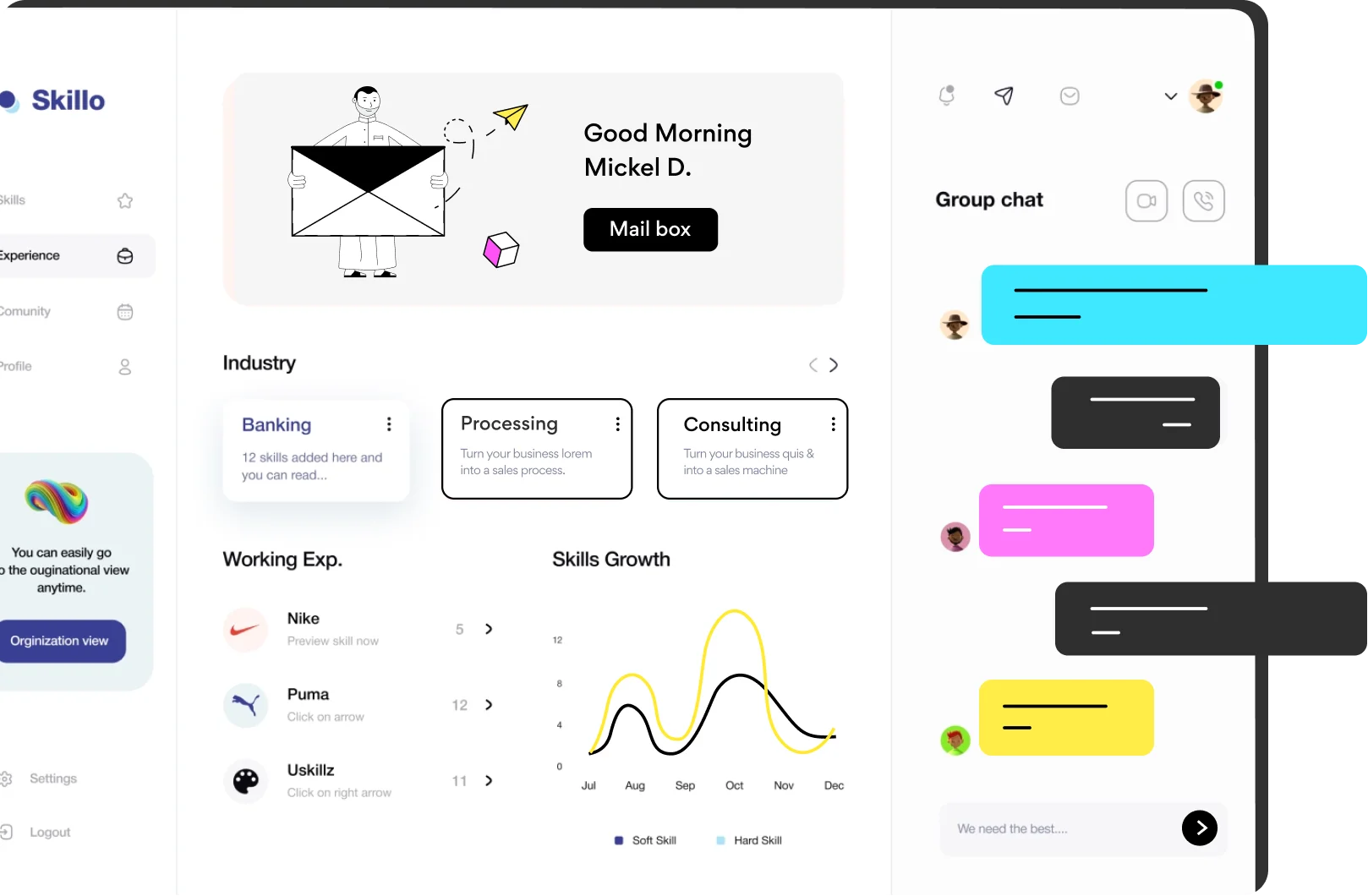

FEATURES

Everything starts with a Marketing plan.

- Amazing communication.

- Best trending designing experience.

- Email & Live chat.

First-Class Marketing Services

Maintain Intent

Accurate Information

Quality Leads

Trusted Partners

WHY CHOOSE US

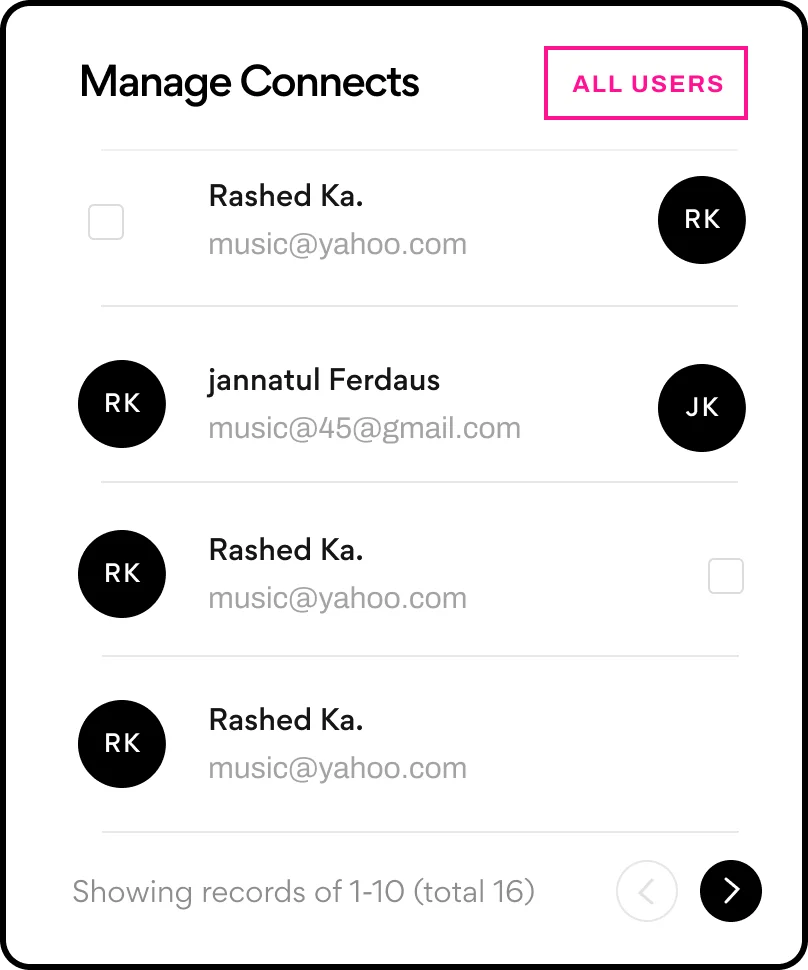

Get quality Leads in single click.

Turn your business into a sales machine today 3x faster reveneu than other market.

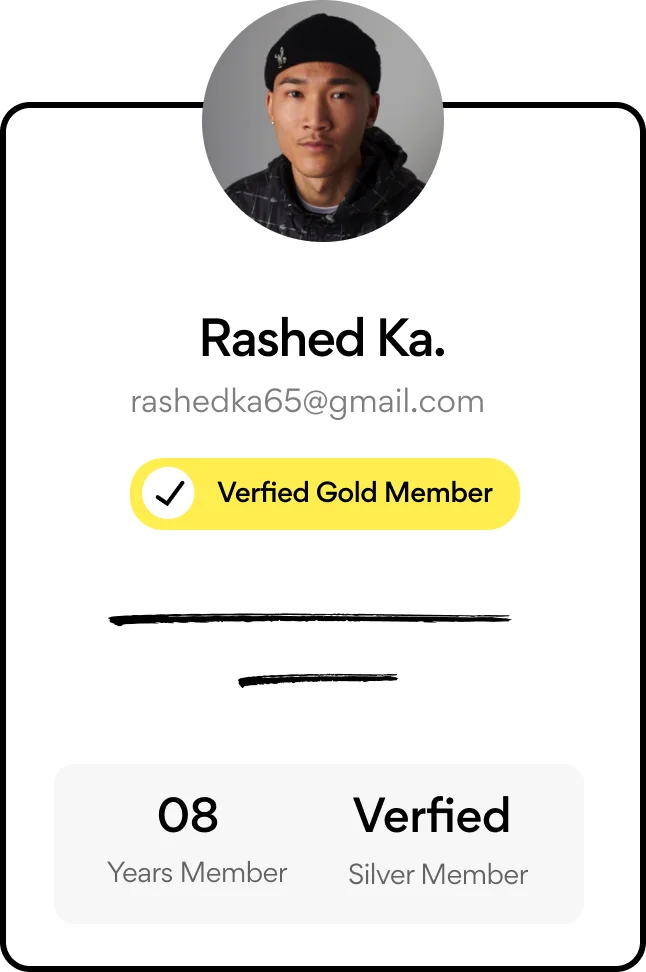

Secure & trusted by Trust Pilot.

Certified by AWP internal Inc.

Created revenue

Cumulative trading volume

Million Insurance Coverage.

Country & Regions

Successful Projects

SUCCESS STORIES

See the success stories from our customers.

“WordPress has been a great success—with WordPress VIP giving us that enterprise”

Steve Jacobs. Pran inc.

Sally Taylor. Dev inc.

Rating

Conversation has been a great success with top assured quality.

Customer

FEEDBACK

What our clients think about us.

After using Vault my business skyrocketed! After using Vault my business skyrocketed! I would gladly pay over 600 dollars for Vault.

Quality & Cost: 5.00

Google.

It really saves me time and effort. Vault is exactly what our business has been lacking. Thanks to Vault, we’ve just launched our 5th website!

Quality & Cost: 5.00

Gravity inc.

I just can’t get enough of Vault. I want to get a T-Shirt with Vault on it so I can show it off to everyone. I will recommend you to my colleagues.

Quality & Cost: 5.00

FAQ

Questions & Answers

Have Any Project? Let’s Talk & Grow your Business

We’re ready to help you. Our team of experts is here, just send a message.